Introduction

In the midst of the 2017 bull market, John Pfeffer, former KKR partner and McKinsey consultant, penned one of the most fundamental evaluations of native chain assets, “An (Institutional) Investor’s Take on Cryptoassets” In his paper, Pfeffer concisely laid out why he believed Bitcoin was unique among digital assets as a long-term investment opportunity, and that why the very nature of blockchain technology means any other chain (and specifically the native asset thereof) is likely a fundamentally poor investment on a long term, risk-adjusted basis once the technology reaches mature equilibrium. To his deserved credit, many of the forecasts he made back in 2017 have proven out almost exactly as he predicted, an impressive record given how different the industry was at that time. Though the final version was published in December 2017, the first iteration of the paper was written in June 2017, when ETHBTC was 0.09 - 0.15, compared to 0.035 today. From June to December 2017, Bitcoin ran from $2,500 to $17,500 and Ethereum from $370 to $750.

In Pfeffer’s words, a summary of his position:

Blockchain technology has the potential to disrupt a number of industries and to create significant economic surplus. The open-source nature of public blockchain protocols, combined with intrinsic mechanisms to break down monopoly effects, mean that the vast majority of this economic surplus will accrue to users. While tens or perhaps hundreds of billions of dollars of value will also likely accrue to the cryptoassets underlying these protocols and therefore to investors in them, this potential value will be fragmented across many different protocols and is generally insufficient in relation to current valuations to offer a long-term investor attractive returns relative to the inherent risks.

The one key exception is the potential for a cryptoasset to emerge as a dominant, non-sovereign monetary store of value, which could be worth many trillions of dollars. While also risky, this potential value and the probability that it might develop for the current leading candidate for this use case (Bitcoin) would appear to be sufficiently high to make it rational for many investors to allocate a small portion of their assets to Bitcoin with a long-term investment horizon.

In this paper, we revisit evaluating native blockchain assets by using the largest and most widely adopted, Ethereum, as the base example. Despite nearing its 10th anniversary, many investors and developers in the industry are currently mired in deep debate about what ETH is, how it should be valued, and what a fair valuation ultimately should be. The pendulum seems to swing back and forth between ETH as a cash-flowing asset much like equity, ETH as an internet-native commodity, ETH as money, or even a new chimera asset with traits of all three. This paper represents our contribution to the discussion.

We briefly touch on Bitcoin and its increasingly solidifying role as a non-sovereign store of value before turning the majority of our attention towards exploring how we believe ETH is evolving and thus how it should ultimately be valued from a rational, long term investor’s perspective.

It is important to underscore one point about all of this: Ethereum and other blockchains can be immensely successful and capture substantial shares of the market, but that does not necessarily mean value accrual to investors holding the native assets of those chains justifies the asset as an investment based on expected fundamental growth or future cash flows today. Are increases in price of those assets important for each ecosystem? Absolutely, but the value of the network and the value of the asset itself are not necessarily one and the same.

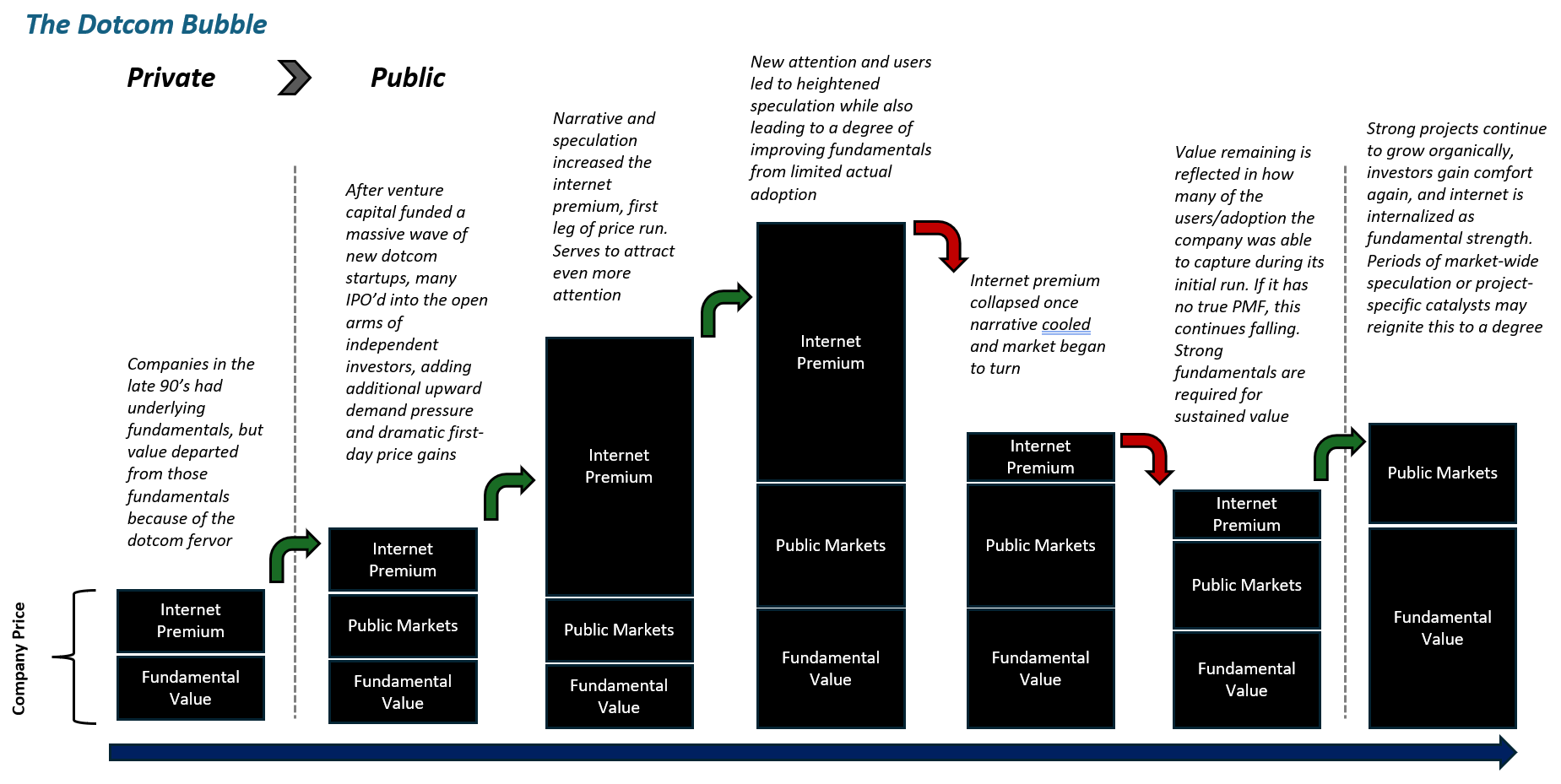

All outlooks are over a long-term horizon where the technology has progressed to the point of mature equilibrium. In the initial paper, this was posited to be a 10 year horizon. While fundamentals are playing an increasingly prominent role in evaluation, there remains a significant degree of speculative forces in the cryptoasset market that still drive pricing.

The Primary Arguments of Pfeffer’s Original Paper

Let us begin by reiterating some of the key takeaways of the 2017 paper. First and foremost, Pfeffer posits that the inherent strengths and open-source nature of blockchain technologies will prove to be a highly disruptive force in industry, ultimately accruing significant value back to users. As such, aside from a cryptoasset emerging as a dominant non-sovereign store of value, the very same properties that will enable blockchains to be disruptive will also ultimately lead to high fragmentation of the value they can ultimately capture. Though he estimates this to be on the orders of 10s or 100s of billions, the ease of replication and open-source nature will lead to hundreds or thousands of assets splitting that value rather than significant accrual to a select few.

At mature equilibrium, native assets are ultimately means of allocating and paying for computing resources on the network. This applies to gas tokens and many Dapp utility tokens and notably excludes the potential for one to emerge as a store of value, a role into which Bitcoin is increasingly growing. For these protocols, the quantity theory of money (\(MV=PQ\)) enables us to calculate the required money stock of a network (\(M\)) based on the economic demand of that network (\(PQ\)) and speed at which the asset is spent within that economy (\(V\)). For reasons we explore in depth throughout this paper, \(PQ\) is low at equilibrium and V high, thus rendering the requisite value of the network relatively low.

Metcalfe’s Law (network value \(V \propto \Theta N^2\)) is frequently cited as a justification of the high values these networks have historically reached. However, it is important to stress that the ultimate value of a network comes from the ability to extract rent from that network, not the network itself, and due to their inherent properties, native cryptoassets have limited ability to capture sustained rent \(\Theta\) from the network. Why? Primarily because the alternatives to blockchain networks (e.g. traditional non-distributed technologies) are easily accessible and relatively low-cost. As such, Pfeffer takes the position that:

The network value of a tokenised version… will by construction be a small fraction of the enterprise value of its centralised, joint-stock-company equivalent” and because of that, “[t]he disruption of traditional networked businesses by decentralised protocol challengers will represent an enormous transfer of utility to users and an enormous destruction of market value. Great for users, the economy and society; bad for investors.

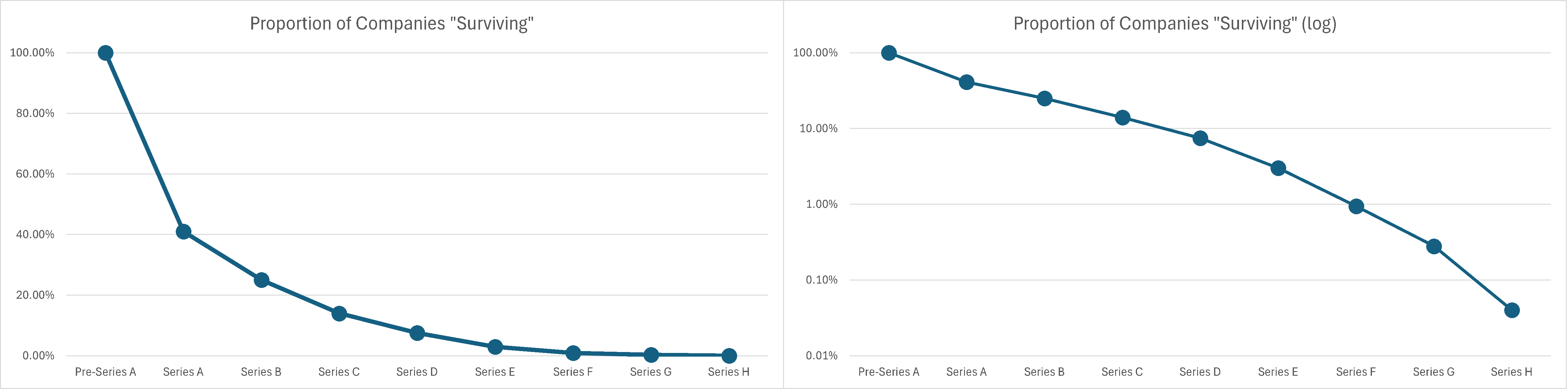

The nature of the protocol economy and the rapid iteration that it allows means that the number of startup attempts - and failures - will be high, and that the achievable value of each marginal attempt lessens over time. Modularity and abstraction, coupled with these high failure rates, suggests selecting winners a priori will be incredibly difficult, especially because the winners likely have yet to be launched. The lack of formal ties to protocols, incentive-driven coalitions and ease of forking will lead to the continued erosion of sustainable rent captured by any one network.

Looking back seven years later, it is difficult to argue with any of these main points. The continued launches (and failures) of competing layer 1 networks, and now layer 2 and layer 3s, where the key value propositions largely fall along the lines of “more transactions for less cost” all point to a highly competitive and highly fragmented market where rent capture is continuously compressing towards zero.

There are however a few predictions first posited that have played out slightly differently than Pfeffer expected back in 2017 when Ethereum was still years away from becoming a proof of stake network, had no fee burns or layer 2 networks, and before DeFi and most applications as we know them existed.

Dilution of Value Through Forks

An interesting business idea that someone could logically pursue at some point would be to raise capital to fund a crack team of mercenary blockchain developers and systematically target technically-mature or maturing protocols where there is still a significant economic rent premium and arbitrage that value via hostile forks of those protocols in a way that reduces cost and/or improves functionality to users and reassigns network tokens held by the incumbent developer team and backers to the insurgent team and backers.

While largely correct that at equilibrium multiple forks will exist that erode economic surplus, this position may have underestimated the lock-in and network effects that Ethereum has been able to generate, ascribing slightly too much ease to forks diverting development activity and users. Rather than simply a proliferation of forked Ethereums diluting value, this has largely played out in scaling space on top of Ethereum. Modular rollup kits such as Conduit, Caldera, and Altlayer make it trivially easy to deploy new customizable blockchains (almost entirely EVM L2s) through what are effectively SaaS platforms . For example, Conduit offers a mainnet L2 or L3 chain deployment for $3,000 / month + 5% of sequencer profits. The chain can be deployed in 15 minutes. https://www.conduit.xyz/pricing/rollups The ease and low-cost nature of deployment on top of Ethereum, coupled with the heightened customizability and near-zero cost to users to transact mean that every marginal rollup launched through these providers arbitrages yet another slice of value away from the ever-decreasing rent that the chain before it was able to capture. At competitive equilibrium, surplus available to these scaling chains is 0, and Ethereum’s lower than it otherwise may have been.

There are assuredly rival L1s such as Solana, Aptos or Sui, but the long list of near-defunct ghost chains suggests the forking of users and developers in a sustainable way is incredibly difficult, and the viability of the top new contenders today is still very much in question. Major ecosystem players have shown their commitment to the canonical forks (e.g. Circle and Tether do not support native issuance on Ethereum POW). Though chains are duplicative, developers are not and there appears to be a stronger tie-in effect than he originally gave credit for, despite the open-source nature and lack of contractual restrictions. Undoubtedly there is a subset of mercenary developers that chase incentive bonuses sprayed by new chains, but the majority remain with the ecosystem of choice, such as Ethereum/EVM or Solana.

With that said, we should note that the rise of Solana is an example of his initial prediction: enough incentives would drive the creation of alternative networks that would compete away surplus. Will rent capture go to 0 on Ethereum? Likely not, but it is realistic to expect that it will settle at a level low enough that an investment in the native asset ETH is difficult to justify. We are seeing this play out today - and importantly, it is also necessary to highlight that while everyone recognizes Solana as a competitor to Ethereum, nobody talks about BCH, BSV or LTC eroding BTC’s value.

The proliferation of L2s and long tail of alternative L1s - Solana a prime example- are indeed all examples of his core position, but aspects of Ethereum’s moat may have proven more defensible than perhaps initially expected in 2017. In other cases however – specifically for many Dapps - this was bang on. How many times does one hear, “Uniswap or Aave but on [insert new chain]”? For reference, Uniswap has been forked 791 times, Compound 142 times and Aave 63 times . https://defillama.com/forks

The 2020 Sushiswap vampire attack on Uniswap is a canonical example of this happening at the application level . https://www.coinbase.com/learn/market-updates/around-the-block-issue-9 A single developer forked (e.g. copied) Uniswap’s code and added a few additional community-focused features, such as a governance token and staking, as a way to improve on Uniswap and cut into its market. It was wildly successful, allowing Sushi to siphon hundreds of millions in liquidity from Uniswap in just a few months. Unexpectedly, the high-profile nature of the attack and Uniswap’s response (airdropped own governance token) actually served to increase Uniswap’s liquidity and size in the following months. The rush of deposits into Uniswap to be deployed into Sushi liquidity, the discourse this attack created, and the $1400 airdrop to Uniswap users all effectively contributed to making this the start of DeFi’s “coming out” party . https://www.coinbase.com/it/learn/crypto-basics/what-is-uniswap Uniswap remains a top decentralized exchange today, but its dominant position is being continuously eroded by new, more innovative competitors.

Forking with marginal improvements remains common practice today. Take the transformation of the top decentralized exchange on Base, Aerodrome . https://medium.com/@aerodromefi/introducing-aerodrome-9af62848b876 The team started out by duplicating aspects of existing mature open-source protocols (Uniswap, Convex, Curve) on a Fantom-based DEX, Solidly, iterated on the build on OP Mainnet as Velodrome, before ultimately copy and pasting the Velodrome code to deploy on Base, a somewhat-commoditized OP Stack L2, as Aerodrome. Through all of this, the team created a full token allotment of VELO plus an additional full AERO token allotment for relatively little marginal effort. Although not “hostile”, the team followed the exact path forecast in 2017, forking open-source code to create new token floats, arbitraging value and benefitting considerably. But as more DEXs are spun up on the next marginal chain to launch, the capturable value will continue to decrease over time. Ironically, portions of Aerodrome’s source code is now registered under a Business Source License (rather than open-source) in order to prevent others from leveraging their code as they did with other protocols, primarily to strengthen the sustainable rent capture \( \Theta \).

A Chain’s “Economy” Expanding to Include Other Chains

In the 2017 paper, Ethereum’s ‘economy’ was posited to be simply the cost of computational resources required to run the chain. Again, while not incorrect, the ultimate addressable market of this formulation was somewhat underestimated. Whereas Pfeffer deemed that to be the full cost of computational resources for the L1, he (quite fairly) failed to account for the fact that L2s and L3s would also a) exist and be at the center of Ethereum’s roadmap and b) denominate and provide services in ETH, rather than alternative native gas tokens. L2s using ETH are the core moneyness extension and while his predictions were not exactly wrong, he did not explicitly predict forks (e.g. L2s) would also adopt ETH as the base asset rather than using their own to pay for compute resources. This fact is one of the core tenets that many in the industry use today to justify ETH’s lofty valuation.

Bitcoin: Solidifying its Position as the Non-Sovereign Store of Value

It is increasingly clear that Bitcoin has differentiated itself from other cryptoassets as the leading candidate to be a non-sovereign store of value, playing much the same role that gold traditionally has in traditional markets. Pfeffer was confident in BTC’s path dependency back in 2017 and argued that this directionality would continue, as it has. We see no evidence that this forecast has been disproven - only solidified - and as such, will just briefly recap his initial estimation here and provide a revised estimate based on up to date data.

At the time of his writing, the estimated value of above-ground gold was $7.8T. Today, that same stock is worth roughly $16.8T and of that, nearly 40% can be attributed to the financial markets - bars, coins, ETFs and central bank reserves https://www.gold.org/goldhub/research/market-primer.

In addition to gold reserves, Pfeffer argues that central banks would also look to diversify reserves into BTC to reduce reliance on the US dollar and US-controlled payment rails such as SWIFT. Though perhaps somewhat far-fetched at the time, there is increasing evidence that this could occur. Bhutan holds the equivalent of 28% of its GDP in Bitcoin reserves through its active involvement in mining (~$1B), El Salvador already purchases BTC as a state asset, the Chairman of the US Federal Bank has called BTC a rival to gold, and the US president-elect has indicated intent to create a national strategic BTC reserve https://www.centralbanking.com/fintech/crypto-assets/7963449/bitcoin-is-a-rival-to-gold-not-the-dollar-powell https://www.coindesk.com/markets/2024/11/12/el-salvadors-bitcoin-stash-rises-above-500m-but-bhutan-story-might-be-even-bigger/ . Non-gold sovereign reserves are now ~$12.9 trillion (up from ~$11.1 trillion) representing a slightly lower 85% of total reserves (down from 89%).

Together, Pfeffer calculated that BTC could have an ultimate potential value of ~$5-15T, or $260-800K per BTC at maturity. In 2017, that represented a 20-60x potential return. Rationally, allocating a small portion of a portfolio to an opportunity with a -1x:60x return profile and positive EV makes sense, even if the probability is low (5%).

With Bitcoin above $90,000 today, does the math still hold? As a simple exercise, if we use the same approach, updated with the most recent numbers, and assign a slightly higher chance of success (e.g. 20%) of this occurring given its trajectory, we arrive at a similar positive-EV outcome but with lower potential return multiple Note our calculation for the original estimate is directionally the same but mildly lower due to small differences in assumptions.. Though the upside potential is still significant, it has no doubt waned somewhat given Bitcoin is already worth 7x what it was in 2017.

| Original | Now | |

|---|---|---|

| BTC Price | 10,000 | 90,000 |

| Chance | 5% | 20% |

| BTC Price Target Low | 217,304 | 357,820 |

| BTC Price Target High | 670,427 | 1,117,936 |

| EV Low | 865 | -18,436 |

| EV High | 23,521 | 133,587 |

| Return Multiple Low | 22 | 4 |

| Return Multiple High | 67 | 12 |

Ethereum is Valuable – But the Risk Adjusted Upside is Hard to Rationalize

It is likely that the combined network values of all utility protocol cryptoassets together will total between tens of billions and hundreds of billions of dollars. That is significant value, but not when compared to the current ~$250 billion combined network value of protocols other than Bitcoin. Investing in utility protocol cryptoassets could make sense if their current network values were one or two orders of magnitude lower than they currently are, but at current valuations, the risk/return to investors is not attractive.

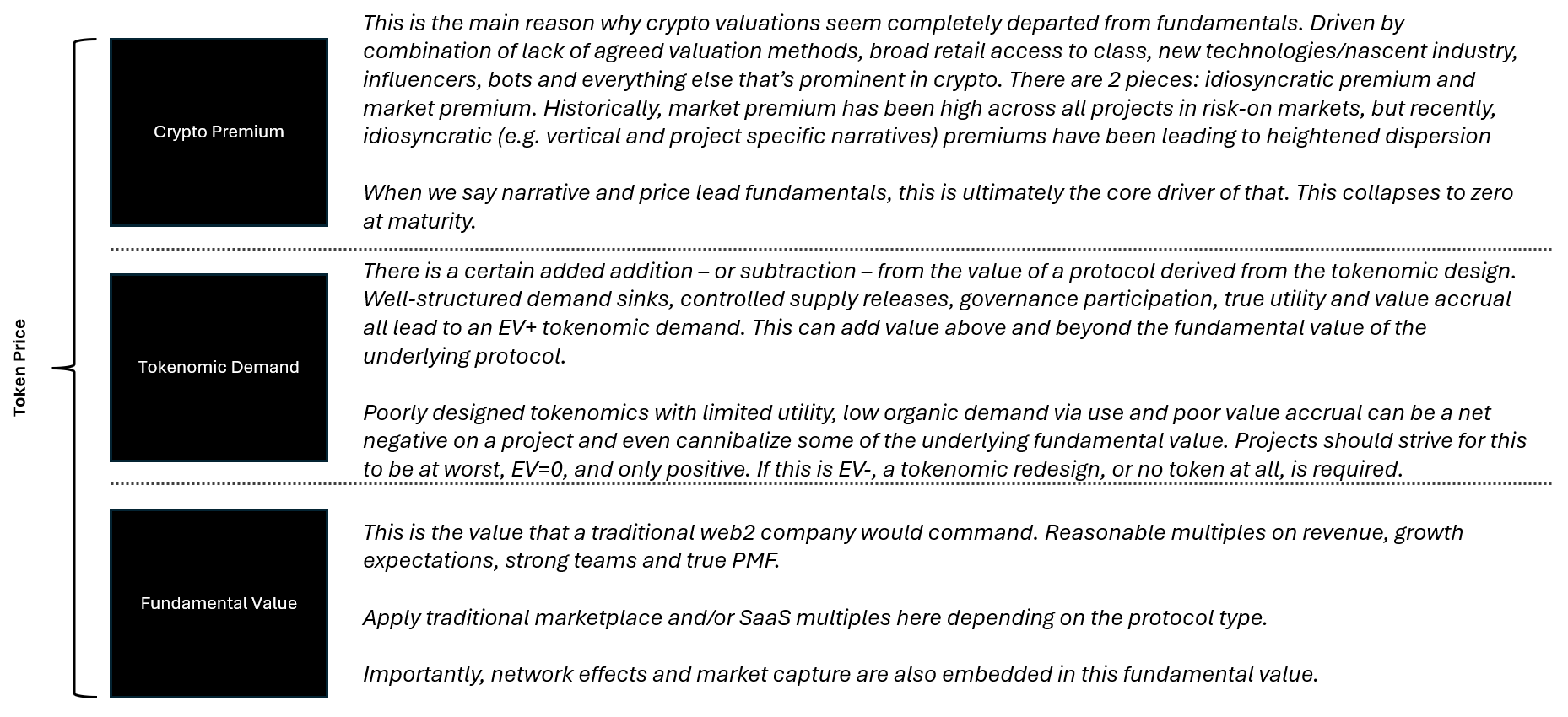

The current combined market cap of all cryptoassets is roughly $3.4T. Bitcoin alone is $1.9T of that, meaning the aggregate value of all other tokens (L1s, L2s, Dapps, etc.) is $1.5T. Despite these lofty numbers, it is widely known that many cryptoassets are priced substantially beyond their fundamental value and there remain many defunct or zombie projects with non-zero floating token supplies that contribute to buoying this aggregate market cap number. There are assuredly projects of significant quality with fundamentally sound models that are worthy of significant valuations (we explore this in depth later), but the multi-billion dollar values currently assigned to many memecoins and abandoned forks are an example of this phenomenon.

Specifically looking at Ethereum, its market cap is ~$400B today, roughly two-thirds of its 2022 peak of nearly $600B, and still well below its $500B height in early 2024. Why do we see such massive swings in value of Ethereum (and many other cryptoassets, such as XRP’s recent 450% move up) when compared to equities? First, many are largely speculative and highly exposed to shifting geopolitical and macro landscapes as well as industry-specific developments such as new infrastructure developments that fundamentally shift the trajectory of the technology. But also, and likely more importantly, many of these assets are so severely departed from fundamental value that when markets shift to risk-on or risk-off stances, they react especially violently to any marginal new information irrespective of actual likely impact.

Why? The industry is young and there are limited true cash flows, moats or other requisite sustainable value that set an actual price floor, and many of those that do exist are incredibly circular and reflexive. The aggregate P/S for the QQQ ETF, for reference, is 5.5x. Nvidia, the speculative AI darling of 2024 with a near monopoly on high-moat AI hardware, has traded at a P/S of 30-45x, against $30B of quarterly revenue. In 2024 alone, Ethereum’s P/S ratio has fluctuated between 65x and 1241x, currently sitting at 250x. That is pricing in a lot of growth for an asset that is already $400B.

But is this even the right way to look at Ethereum? Many traditional equity investors take this tack and value ETH off its cash flows, ascribing expected growth in transactions and revenues to back into discounted cash flows. But many increasingly argue no, fees will trend to $0 and thus viewing ETH as a cash flowing asset makes little sense. While it is understandable that there is disagreement about how to view a new-to-the-world asset class, Ethereum is nearly 10 years old, and though naturally being in its infancy relative to joint stock corporations or commodities, it is perhaps a sign of a more fundamental issue that the industry continues to shift the narrative in order to justify its lofty valuation and even loftier expected future valuation. The technology is still effectively a beta release given the frequent significant changes to its stack, but until the point that it is “finalized”, this shifting foundation only serves to increase the risk associated with any investment, and thus necessitates an even more optimistic outcome to justify its current valuation.

In the following sections, we separately evaluate the three main lenses through which Ethereum is often valued: as a cash flowing asset akin to equity, as an internet-native commodity, and increasingly, as a money for an emerging internet-native network state. One could justifiably value ETH through any of these methodologies, or perhaps even as a sum-of-the-parts combination of all three. However, we argue ETH on its current trajectory - and many native gas and payment tokens in general - are far more akin to internet-native commodities or working capital at mature equilibrium.

ETH as a Cash Flowing Asset

One can look at modeling Ethereum off of its forecast revenue generation. Many industry analysts have gone deep into trying to forecast various revenue vectors for Ethereum 5 years out, such as possible MEV capture by non-existent app-specific L3s or restaking flows. By and large, while commendable, this is incredibly difficult to do accurately and introduces massive assumptions that drive the majority of model value. Crypto is hard enough to forecast 3 months out, let alone 5 years. The problems are further compounded by the fact that Ethereum’s own economic structure is continually being changed (such as EIP-1559, EIP-4844 and EIP-????) which means any such forecast is built on top of a highly unstable foundation EIP-1559 introduced the base fee burn mechanism; EIP-4844 introduced blobs for rollup data..

Further, the introduction of the burn mechanism through EIP-1559 seems to have centered much attention on whether or not ETH is a deflationary asset, with many defining the burn as the network’s true revenue. We view this as largely a red herring given that Ethereum’s monetary policy has effectively codified inflation to remain below 1.5% and typically 1%, lower than most developed market currencies. From this standpoint, its monetary policy is quite sound for the time being.

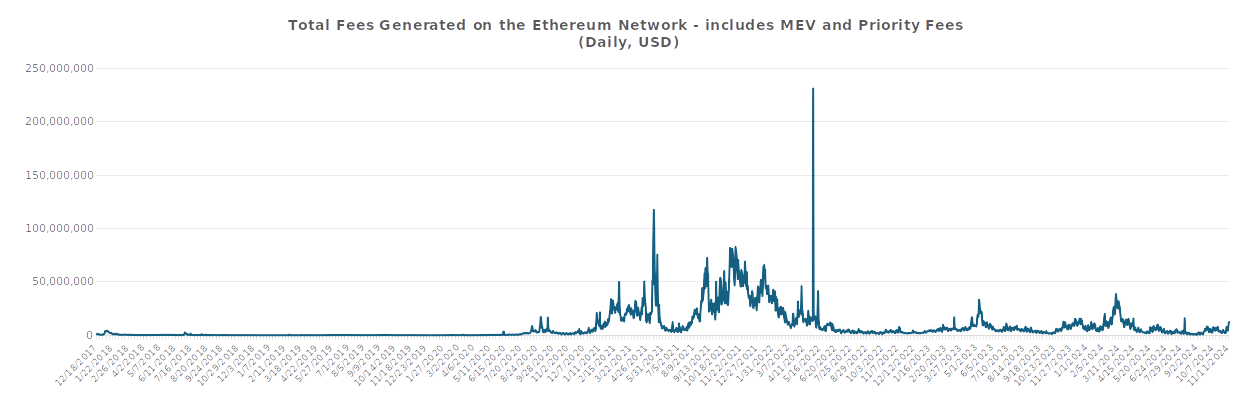

As such, we will take a simpler approach, which is arguably even more optimistic in its outlook than a DCF normally would be. Quite basically, we model a growing perpetuity against the fee burn required to offset inflation currently (~$2.25B per year). No long-term assumptions about yet-to-be built products or adjusting growth rates across periods. Simply, what cash flow is needed to first make ETH non-dilutive for the marginal holder, and then add a generous long-term growth rate on top. Given that the first number is ~180% above current levels at the time of writing, it is hard to argue this is an unfair place to start, especially with the continued migration of execution to layer 2 networks and network fee generation near all time lows:

What is a fair discount rate on ETH? Endowments and pensions roughly target inflation plus 5%; equity investors historically discount closer to ~10%; PE investors come in around 20-25% and VC starts creeping up to 30-40%. The risk of digital assets clearly suggests the upper end of this spectrum is appropriate, but we’ll look across all stakeholders in our model as ETH.

Assuming ETH offsets its current issuance into perpetuity ($2.25B annual inflation), we will also assign an above average growth rate of 5% into perpetuity. Note, there is little reason to expect a consistent, or even growing, revenue level going forward given Ethereum’s historical track record and for all of the reasons we explain, but we will make this concession. This simplistic model also internalizes the network issuance into a simple bar to clear, above which Ethereum becomes ‘profitable’. It also provides a long-term target that needs to be hit if transaction fees are to be adequately high to fund node participation in the network. Issuance today is the main mechanism through which they are paid, but the ability to expand the validator set is entirely reliant on the price of ETH in fiat denominations increasing.

With those assumptions in place, based on a $2.25B run rate, growing at a generous 5% into perpetuity, ETH appears highly overvalued today as a cash flowing asset at $400B.

$$ PV = C / (R - G) $$

| Fees | 2,250,000,000 | ||

| Long term growth: | 5% | Est. Present Value: | Per ETH |

| Pensions: | 7% | 112,500,000,000 | 934 |

| Equities: | 10% | 45,000,000,000 | 374 |

| PE: | 20% | 15,000,000,000 | 125 |

| VC: | 30% | 9,000,000,000 | 75 |

This is a fairly simple back-of-the-napkin approach to valuing ETH, but is consistent with how many analysts seem to ascribe value to the fees and token burn of ETH while treating issuance as a network cost. A more accurate approach is to break down the value flow by stakers versus holders, which fundamentally changes the economic breakdown and turns network issuance into a value-positive dynamic for a subset of network participants.

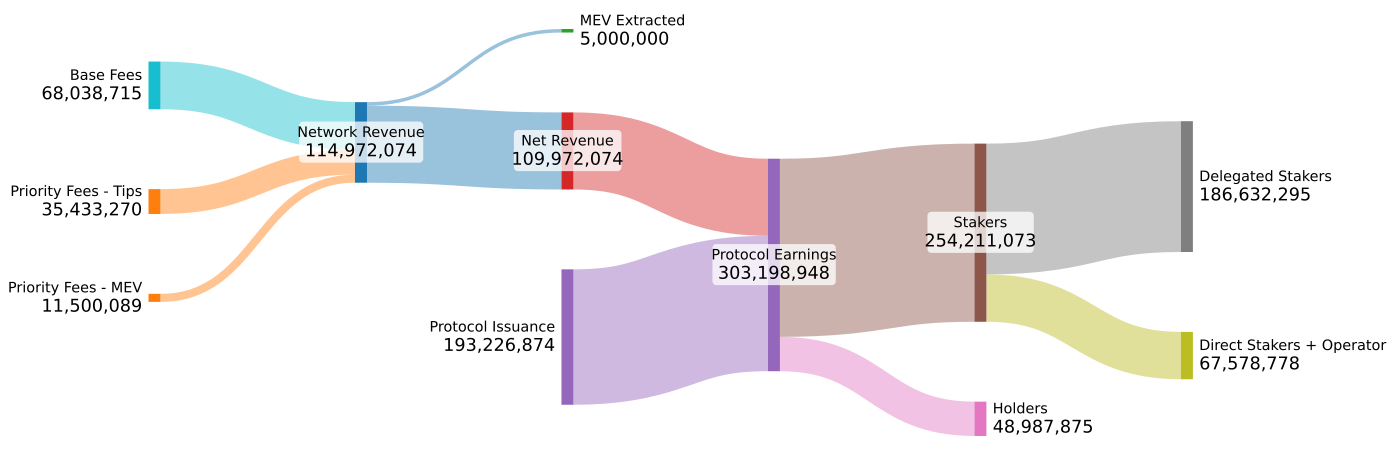

Specifically, because new network issuance is paid 100% to stakers and node operators, it should be seen as a direct transfer from token holders to token stakers as an internalized tax for securing and facilitating the network. Through this lens, holders are operating at loss, but stakers are in aggregate operating at a sizable profit, as we demonstrate below.

For this analysis, we can use some rough estimates to get a sense of how much value ends up in the hands of holders and stakers, looking at September 2024 as an exemplary month. Roughly 28% of all Ether is currently staked, either directly or through delegation https://dune.com/hildobby/eth2-staking. That leaves 72% of ETH freely circulating to be held or used in other ways. For the purposes of this exercise, we treat all 72% of this as simply ETH held (much is likely used in DeFi, etc.).

Holders are simple. They earn their share of the network’s net burn of base and blob fees. In September, that was roughly $68M. As such, holders received $49M of ‘buybacks’ from the network in terms of net token burns. They receive no other inflows of value. So, the 72% of ETH circulating (~$231B worth at the time) accrued $49M of value for the month.

The economics for stakers are far more interesting. Similar to holders, they receive a prorated share of the network’s overall burn, amounting to $19M over this period. However, they also earn additional tips from priority fees and MEV activity. These totaled roughly $35.4M and $11.5M respectively. However, MEV activity remains extractive and one can estimate that ~$3-5M is captured each month by bot activity, largely in the form of fees paid. That means that stakers receive ~$30M from priority fees and $11.5M from MEV activity, giving them pre-issuance revenue of $61M, almost 25% more than what accrued to holders despite representing just 1/3 of the respective share of the network.

Network issuance entirely flows to stakers and validators. That amounted to $193.2M in new issuance. This brings the total value flow to stakers to $254M for the month versus just $49M for holders.

We can break down the value within staking as well. Of all ETH staked, roughly 81% is staked through centralized exchanges, pools or liquid (re)staking protocols, and the remainder is staked directly. For simplicity, we estimate that delegated stakers pay 10% to the node operators and protocols for staking on their behalf and are including solo stakers in this direct staking group. The actual weighted effective amount likely falls somewhere between 5-10%.

Thus, the 81% represented by delegated stakers earn their share of ETH fee burn ($15.4M) and 90% of priority fees ($30.5M) and issuance ($140.7M). In total, delegated stakers earned $186.6M over the month. Direct stakers (19%) captured the remaining $67.6M of value, with $15.1M coming from fees and $52.5M from network issuance.

How does this all shake out? The ~23% of delegated stakers earn a disproportionately high 61% of all value flowing through the network. Direct stakers/node operators, accounting for 5% of ETH stake, earn 22% of all value. MEV bots extract just under 2%. That means holders, accounting for 72% of all ETH in circulation, receive just 16% of all value of the network.

| % of Holders | Stake Capture | Overall Capture | |||

| MEV Bots | 0 | 1.6% | |||

| Delegated Stakers | 22.7% | 73.4% | 60.6% | ||

| Node Operators | 5.3% | 26.6% | 21.9% | ||

| Holders | 72.0% | 15.9% | |||

| Total | 100.0% | 100.0% | 100.0% | ||

| Base Burn | Priority Fees | Issuance | MEV | Total | |

| MEV Bots | 0 | 0 | 0 | 5,000,000 | 5,000,000 |

| Delegated Stakers | 15,412,130 | 22,158,464 | 140,688,487 | 8,373,215 | 186,632,295 |

| Node Operators | 3,638,710 | 8,274,806 | 52,538,387 | 3,126,874 | 67,578,778 |

| Holders | 48,987,875 | 0 | 0 | 0 | 48,987,875 |

| Total | 68,038,715 | 30,433,270 | 193,226,874 | 16,500,089 | 308,198,948 |

| Base Burn | Priority Fees | Issuance | MEV | ||

| MEV Bots | 0.0% | 0.0% | 0.0% | 30.3% | |

| Delegated Stakers | 22.7% | 72.8% | 72.8% | 50.7% | |

| Node Operators | 5.3% | 27.2% | 27.2% | 19.0% | |

| Holders | 72.0% | 0.0% | 0.0% | 0.0% | |

| Total | 100% | 100% | 100% | 100% | |

One way of interpreting this by way of loose analogy is as follows:

- Delegated Stakers are most akin to S-Corp shareholders of Ethereum the network. 23% of all ETH held falls into this bucket. Node Operators and Direct Stakers are in essence service providers for the network, working to ensure the chain operates and provides settlement and security. These could fairly be thought of as either COGS or operating expenses. Roughly 5% of ETH held falls into this category.

- Holders are more akin to customers of the network, acquiring the tokens for use across DeFi or other activities or for speculation. Importantly, they primarily pay fees for using the chain (transactions) and to receive the security of the network (issuance). Roughly 72% of all ETH can be seen as being in the hands of ‘customers’.

- MEV actors are 3rd parties acting against perceived inefficiencies in the network. They impact Ethereum in both positive and negative ways, but ultimately end up earning a small profit for their actions. As a very loose parallel, think of drop shippers and dupe peddlers on Amazon’s marketplace, arbitraging apparent pricing discrepancies or simply acting in predatory ways by selling knockoff goods. These MEV actors represent a negligible amount of ETH held in total but do account for a significant amount of activity.

| ETH Staker's Income Statement | ETH Holder's Income Statement | |||

|---|---|---|---|---|

| Revenues | 100% | Revenues | 100% | |

| Allowances | 1.62% | Allowances | 0% | |

| Net Revenue Margin | 98.4% | Net Revenue Margin | 100% | |

| Network Services and Security | 21.9% | Network Services and Security | 394.4% | |

| Marketing and User Acquisition | 15.9% | |||

| Operating Expenses | 37.8% | Operating Expenses | 394.4% | |

| Operating Margins | 60.6% | Operating Margins | -294.4% | |

| Other Expenses | 0% | Other Expenses | 0% | |

| Net Pass Through Margin | 60.6% | Net Pass Through Margin | -294.4% | |

On the flip side, a holder’s outlook is far less rosy. Revenues (e.g. network fee burns in this model) reflect the entirety of their value capture, but they bear the entire cost of the network’s issuance given they receive none of that economic flow in return, unlike stakers. Collectively, that inflation tax falls squarely on holders as a subtle toll for security and settlement services and as a result, holders require drastically higher mainnet fee activity to “break even” from the burn mechanism.

It appears unlikely that Ethereum returns to a deflationary state in the long run (barring any major changes to its monetary policy), and especially unlikely that it returns to a state where it is deflationary enough to bring holders back into significant profitability. As such, we can model the value of Ethereum another way, looking at how much the aggregate cash flows to stakers is ultimately worth. To simplify, we will assume the stake rate remains constant and hold the price of ETH in USD constant (a problematic necessity we touch on shortly).

In May, network issuance was ~$265M (the 4th highest month since the Merge), and is down slightly since then, touching $197M in September. The highest month for issuance was March, where $286M was issued. All that is to say, network issuance is flat-to-down over the year. Using $193M as our base month is reasonable (net of MEV extraction), if not skewed slightly high. Network fees of $115M reflect one of the lowest months on record since the Merge, and only one month since then has eclipsed that, resulting in the lowest quarter of fee generation over that same time period. In short, revenues and fees are flat-to-down as well. Despite this, we’ll still ascribe a long-term perpetual growth rate of 5%. Modeling this as a perpetuity, it is again difficult to rationalize ETH as a strong investment given its current ~$400B level. Keep in mind, to many investors Ethereum and blockchain assets more broadly are still venture investments. As such, target returns are measured in multiples, likely necessitating a few-trillion dollar outcome for ETH. Per staked ETH, given these cash flows, there is little upside on a risk adjusted basis. Note that this converges down to the non-staked value we calculated earlier as stake rate approaches 100%.

$$ PV = C / (R - G) $$

| Staker Cash Flow | 3,050,532,878 | ||

| Long term growth: | 5% | Est. Present Value: | Per Staked ETH |

| Pensions: | 7% | 152,526,643,920 | 4,421 |

| Equities: | 10% | 61,010,657,568 | 1,768 |

| PE: | 20% | 20,336,885,856 | 589 |

| VC: | 30% | 12,202,131,514 | 354 |

There is an insurmountable flaw in using network cash flows to model value: circularity. Specifically, the value of these cash flows as denominated in USD is directly tied to the USD-priced value of ETH, the token. As the value of ETH rises and falls, the value of these ETH-denominated cash flows necessarily do as well in terms of USD. There is no extrinsic mechanism in place that separates network activity from how it is valued, and instead, the value of ETH is entirely reflexive to the value of ETH. Unless an investor entirely denominates their portfolio in ETH, this is essentially a death knell for valuing ETH this way. A US-based investor prices an Apple share in USD, not in shares of Apple. So, given Ethereum’s economic mechanisms are ETH-denominated and therefore cannot drive the price of ETH in USD, what does? We explore this in detail later, but this is yet another reason viewing ETH as a cash-flowing security is so problematic.

With that said, for these purposes let us ignore the above circularity issue. Even if ETH is successful in generating cash flows priced in USD far beyond these levels, which equity comparisons are reasonable targets?

|

|

||||||||||||||||||||||||

Ethereum’s potential network and rent capture is already valued higher than any telecommunications company in the world, despite each of them commanding 10s or 100s of millions of users, many billions of dollars in infrastructure moats and average revenue per user 6-7x higher. Visa and Mastercard are fair targets for comparison. But already, ETH transfer volumes are on par with what Visa or Mastercard process every year (~$10T), and despite this, Ethereum generates just a small fraction of fee revenue that Visa alone does: $370M between April and July 2024 vs. $8.9 billion. A 25x gain in revenue would be required to justify a 2x gain in market value. Note this ignores all of the transfer activity happening in other tokens on the network or L2s, simply the transfer volume of ETH the asset itself.

This highlights how low the \(\Theta\) value of the network is. The same technology that makes blockchains so powerful – nearly instant and free transactions – also means that effective rent capture is far, far harder to build and sustain at the utility/network level. Consumer facing applications that enable use of this technology are far better positioned to capture surplus here, having significant margins to undercut traditional payment networks.

Ultimately, blockchains at their core are distributed databases, one piece of a company’s backend stack and because of this, database companies are likely the more appropriate comparison.

| Top Database Companies by Market Value | |

| Alphabet | 1,900,000,000,000 |

| Meta | 1,300,000,000,000 |

| Oracle | 435,000,000,000 |

| Ethereum | 400,000,000,000 |

| SAP | 250,000,000,000 |

Ethereum has already far surpassed top companies such as Snowflake, IBM, and SAP. Oracle is the next closest comparable, just slightly larger than where ETH is currently valued. Beyond those, target companies Meta and Alphabet, with business models far extending beyond information storage and indexing, are valued at $1.3T and $1.9T respectively. But Meta is currently generating $18.5B per quarter in EBITDA, and Alphabet $31.1B. The level of activity and fee generation required to get to these levels would be astronomical. Ethereum needs roughly a 1.8x increase in revenue generation just to offset annual inflation (e.g. become ‘profitable’ for a simple holder), which would amount to $2.25B annually. From there, to generate equivalent cash flows, Ethereum would require roughly a 40x increase, or $85B annually. Taken together, that is a 72x increase in sustained revenue generation to justify a 3-5x increase in market value. Even if you believe ETH can get to those eye-popping revenue numbers to warrant a $1.5T valuation, definitionally ETH is not worth what it is valued at today.

There is also little reason to expect that at maturity most businesses will elect to use a general purpose shared chain instead of their own network (e.g. app-specific chain) given the higher customizability, control and better economics that the latter provides. Much like shared hosting is a thing of the past for most businesses, shared use of a general chain will likely be limited to providing interconnectivity between each company’s own chain at maturity. Shared networks focused on a single use case will likely be an intermediate bridge to this future.

A great amount of justification for Ethereum’s value stems from Metcalfe’s Law, coined by Robert Metcalfe in 1980 to explain how the value of a telecommunication network grows exponentially relative to the number of nodes on the network (e.g. \(V \propto \Theta N^2\)). What is often overlooked is that proportionality does not mean equivalency. While the value of the network grows, from a financial perspective, there is another factor more important: the ability to capture rent from that network.

Meta and Alphabet are both extremely successful companies with highly defensible network positions – as large as any company in the world. Meta has 3 billion monthly users while it is estimated that Google’s products touch nearly 5 billion of the world’s 6 billion internet users. Those are incredibly large networks, and each have monetized them in a way to justify ~$1.5T in value. By comparison, Ethereum has just 5M monthly active users, essentially 1/1000th of Meta or Google. Allowing for a 5-6x growth in Ethereum’s market value, is Ethereum’s ability to capture surplus economic rent truly 150-200x higher than those companies? This is hard to rationalize, especially given ETH’s existing value capture mechanisms are weak (as explained above) and that the entirety of Ethereum’s development roadmap is geared towards further reducing costs and increasing scaling via L2s and shards (e.g. reducing value capture from most activity).

The importance of value capture mechanisms cannot be overstated. For businesses targeting the same functionality or service, how they go about extracting rent is what ultimately leads to enterprise value that flows to an investor. In 1990, Encyclopaedia Britannica earned $650M in revenues and had been profitable every year since the 1930s https://mba.tuck.dartmouth.edu/pages/faculty/chris.trimble/osi/downloads/20007_EncyBrit_A.pdf. Their business was, at its core, making the broadest set of knowledge available through a single source. Recently, Wikipedia does that exact thing in a far, far more efficient manner, with over 4 billion unique visitors to its site last year. Despite that, Wikipedia earned just $180M in revenue, 96% of which came from contributions https://projects.propublica.org/nonprofits/organizations/200049703. Wikipedia is a non-profit organization, so this is not surprising, but it highlights the enterprise’s differing model of how to capture rent (or not), despite offering a far superior product. Now new offerings such as OpenAI’s ChatGPT are changing the rent capture \(\Theta\) again. ChatGPT is just offering aggregated access to the world’s information, much like Encyclopaedia Britannica and Wikipedia before it, but is providing and monetizing that service in a far different manner, allowing them to capture tremendous value. OpenAI’s latest valuation? $157B https://www.nytimes.com/2024/10/02/technology/openai-valuation-150-billion.html.

ETH as Money

Increasingly, the argument that ETH deserves its $400B valuation and seemingly uncapped additional upside is because it is ‘money’ and thus benefits from a somewhat hazy ‘monetary premium’. This is emerging as the leading argument for how ETH justifies its position, now adopted as the native currency on the L1 and by most EVM L2s and L3s for gas. The rollup centric roadmap of Ethereum has generally pushed execution out to L2s while exporting ETH as the base currency/unit of account on those chains.

For ETH to become money, it needs to become the de facto unit of account for EVM. Today, it is not: one can not honestly say that the majority of users price a transaction in ETH over the USD equivalent (even if chain explorers do), nor is that share growing. Applications quote fees in USD, as do analytics sites and wallets. Businesses (e.g. due to developers) may internally denominate certain costs in ETH because that is the unit onchain gas fees are denominated in but will still ultimately reflect any ETH holdings or expenses incurred in USD on their financial statements. Users do not transact on Ethereum because the cost rises, despite the gas requirement as denominated in ETH being constant. That is, it is entirely the fiat-denominated price that drives behavior.

Even so, let’s pretend that ETH does become the de facto unit of account and method of exchange across all EVM chains, and that despite a low likelihood of becoming a true store of value (as we’ve already explored, Bitcoin is the most likely candidate), manages to command some additional premium in a similar vein as silver. As we’ll show, even if the entirety of EVM-world is denominated in ETH, this is still an incredibly narrow use of something demanding a significant ‘monetary premium’. With little basis in quantifiable economic reality, this idea of a monetary premium necessitating Ethereum being worth trillions of dollars is difficult to reconcile.

Valuing ETH as money means that the quantity of theory of money should hold true, represented by \(PQ=MV\). Given we can get rough estimates of the size of Ethereum’s economy (\(PQ\)) and its velocity, we can arrive at a theoretical monetary stock needed to support that economy (i.e. Ethereum’s market cap).

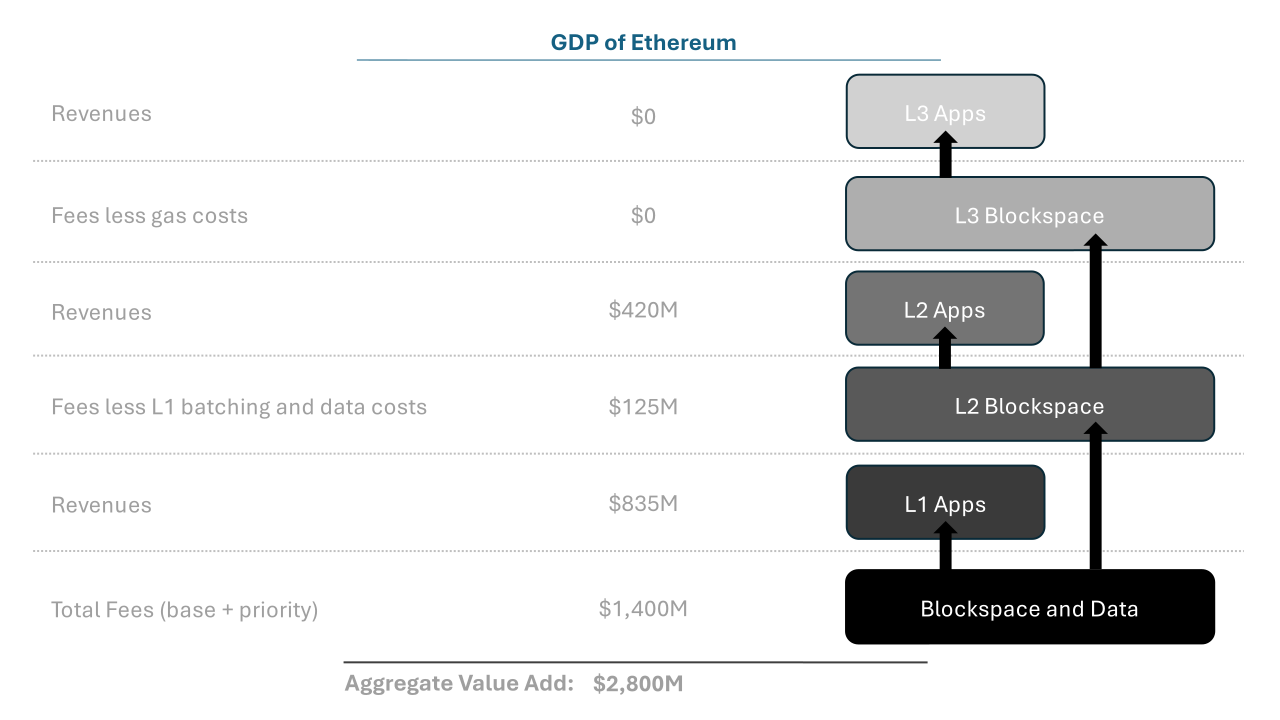

First, to get an estimate of the Ethereum economy, \(PQ\). ETH is primarily used to provision blockspace on L1s, L2s and L3s via gas and DA costs and to pay for some services provided by decentralized applications. Breaking this down, there are essentially 6 layers to the current GDP stack: L1, L1 Apps, L2s, L2 Apps, L3s, and L3 Apps. We can look at the value add of each layer of this stack to arrive at an estimate for Ethereum’s GDP.

For our purposes, we will also look at the past 6 months and then make a simple annualization by multiplying by 2 April through September 2024. Why not just use the past 12 months? Two reasons: 1) EIP 4844 has drastically changed the Ethereum economic structure and any period prior to March 2024 represents a very different economic reality than the period following it, and 2) many of the most prominent L2 chains have only recently gone live – using months prior to many of these contributing to GDP would be undercounting viable ETH monetization sources.

Off the top, we will ignore L3s and L3 Apps for the time being. In the long run, it may prove that these can accrue value, but as of today, costs to transact on these handful of networks is essentially zero, as are fees generated from the limited apps and users that exist. Given the commoditization of these chains and focus on low-cost experience, we expect any revenue generation at this level to remain de minimis. Consumer-facing applications will monetize their users, but in fiat denominations, not in ETH.

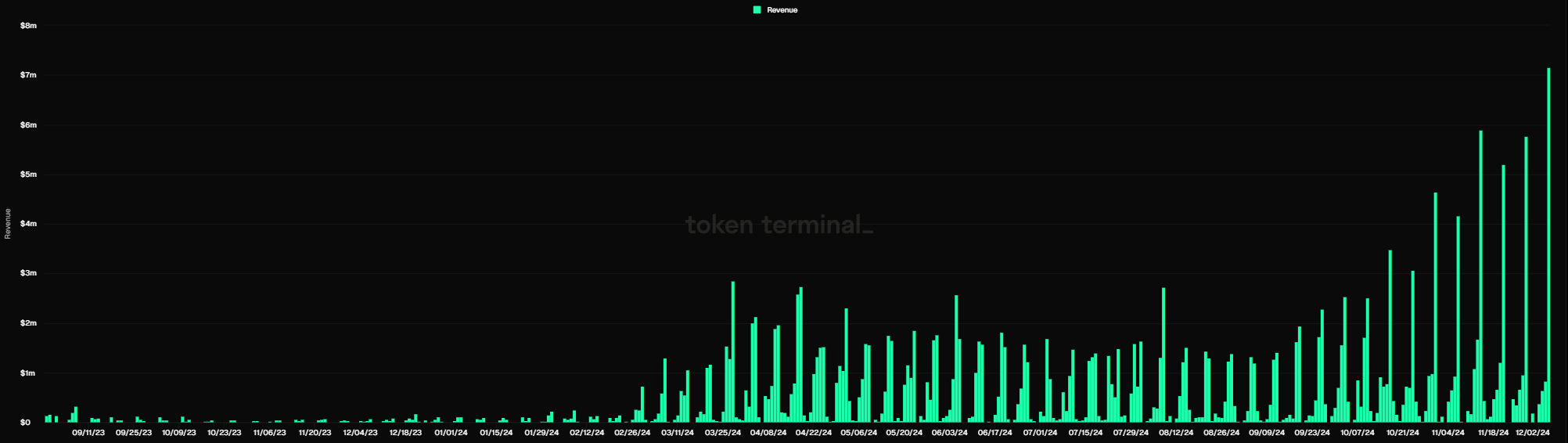

Ethereum L1 revenue is easy to ascertain. Base fees to transact totaled ~$480M over the past 6 months while validators earned an additional $220M in priority fees, paid in ETH. We will use this aggregate $700M number in our estimate All revenue and fee estimates from TokenTerminal. For L1 and L2 apps, this is both an overestimate and underestimate at the same time. Most often fees are not denominated in ETH and the contribution to GDP of app interactions is already captured in the chain revenue fees by facilitating the app transactions, but the estimate for app revenues is likely undercounting the true activity. The true value add here depends on this balance, but should be directionally correct if we want to use this higher assumption.. Thus, the total cost to use Ethereum mainnet is roughly $1.4B annually, representing the ‘value add’ of Ethereum blockspace to the economy.

For L2s, their value add to Ethereum’s GDP is roughly equal to their net profits. That is, the fees that they earn from providing blockspace to L2 apps and L3s net of the costs associated with posting transactions to L1 mainnet. Why do we net L1 costs out? Because they are already accounted for in Ethereum’s revenue, and netting out these avoids double counting. While difficult to get firm numbers across all L2s, the top L2 networks (accounting for the vast, vast majority of activity) generated roughly $62M in net profits over the last 6 months, or $125M annualized.

An interesting aspect of blockchain apps is that consumers still bear the cost of transacting, and as such, pay the gas costs. Given these costs are covered in either the L1 or L2 fee numbers, we can simply look at aggregate revenues generated by these applications as their net value add. Accurate and exhaustive economic activity by applications is a little more difficult to ascertain, but some data platforms provide estimates. Over the past 6 months, apps on Ethereum L1 generated roughly $417M in revenues, or $835M annualized. L2 apps generated ~$210M, or $420M annualized.

This gives us a range of estimates for the onchain ‘GDP’ of Ethereum. That is, the range of economic activity where ETH could viably be used as ‘money’ today. If we exclude all app revenues and just look at L1 and L2 value add, we get a floor of $1.5B annually based on the last 6 months. If we include the entirety of L1 and L2 app revenue, with the embedded assumption that all of these fees are paid in ETH and not app-native tokens or stablecoins (an unrealistic stretch), then we can get an additional $1.3B in economic activity, bringing our total high estimate to $2.8B.

The velocity of ETH largely seems to be flattening out at ~7-8 after falling from ~20 in 2021 and 2022 https://cryptoquant.com/asset/eth/chart/supply/velocity?window=DAY&sma=0&ema=0&priceScale=log&metricScale=linear&chartStyle=line. This trend is largely supportive of a higher monetary value for ETH, as definitionally a low velocity necessitates a higher monetary stock, ceteris paribus. Additional staking or use of collateral could further lower this, but as we explore throughout this paper, the long-term equilibrium likely sees a roughly constant staking rate as seen today, and a lower collateralization rate, and thus higher velocity.

With these pieces in place, we can estimate the required monetary stock of ETH to support the onchain EVM economy. At a low end, ETH’s market valuation should be $220M, ranging up to $400M at the high end. This is 1/1000th of its current market value.

| Low | High | |

| PQ | $1,541,605,404 | $2,799,114,744 |

| V | 7 | 7 |

| T | 120,290,000 | 120,290,000 |

| Est. Money Supply Needed (MC) | $220,229,343 | $399,873,535 |

| Est. Value per ETH | $1.83 | $3.32 |

Through this lens, ETH is often framed as the currency for an emerging “network state”, akin to BRICS or even smaller developed markets. Arguably, this is fair given the reach of the internet, but if this is true… we are already there. The closest comparison will be to M0 as the actual monetary base of this internet nation state. M1 stock is too influenced by a country’s banking structure (e.g. fractionalized deposits at commercial banks) to offer a valid comparison.

Which country should ETH aspire to overtake? Hong Kong? The UK? Mexico? Canada? Well, it already has. In fact, the only currencies with higher M0 in equivalent USD are the Swiss Franc, Japanese Yen, Chinese Yuan, the Euro, and the US dollar. To overtake the Swiss Franc suggests a mere 50% growth in ETH’s M0 ($600B). 100% to overtake the Yen ($800B). China’s $1.7T M0 stock is more interesting, representing a 4x gain from today. The absolute top target here would be matching the Euro or USD – both at roughly $5.5T, representing just shy of a 15x gain.

| M0 in USD Equiv | |

| US Dollar | 5,750,000,000,000 |

| Euro Area | 5,324,903,100,000 |

| Chinese Yuan (onshore) | 1,648,360,000,000 |

| Japanese Yen | 792,778,000,000 |

| Swiss Franc | 611,106,210,000 |

| Ethereum | 400,000,000,000 |

| Aussie Dollar | 229,140,000,000 |

| Canadian Dollar | 186,226,180,000 |

| Mexican Peso | 152,756,169,000 |

| Pound Sterling | 124,803,900,000 |

| Hong Kong Dollars | 75,292,490,000 |

But one must answer this: do you really believe that Ethereum will out compete the USD or Euro, let alone the Yuan or Yen, for global adoption? And if so, over what time period? Given this target effectively entails replacing the de facto global reserve currencies, that would be quite the outcome for an open-source software token to achieve in 5 or 10 years. Unfortunately, no amount of demand for database capacity is likely to result in that level of adoption.

That means that the ‘monetary premium’ of ETH is what drives the vast majority of the perceived value. As we have explained earlier, there will likely be only one sovereign store of value cryptoasset, Bitcoin. For an even deeper explanation, we recommend readers revisit the original paper as to why organic competitive dynamics leads to this conclusion. There is another reason why a successful, heavily adopted smart contract platform is wholly antithetical to it also being a non-sovereign store of value.

Success for Ethereum means full-scale adoption by the largest institutions in the world: Blackrock, Visa, JPMorgan and Fidelity all using the platform, with trillions of tokenized real-world assets onchain such as treasuries, stocks, and USD. But that is precisely the catch. Those RWAs issued and controlled by those US entities very much operate in the ‘real world’. As such, ‘real world’ governments and all of the associated legal and regulatory pressures still apply. Just because a US treasury is issued on Ethereum does not mean the US government is immediately divorced from any influence and removed from the picture.

Now, play this out. In a world where trillions of US RWAs live on Ethereum, what happens if global conflict breaks out? As is done frequently, Ethereum can be forked. And just like what has happened in the past, the ‘canonical’ fork is the one most supported by social consensus. Circle was explicit about only supporting USDC on the new PoS chain following the merge - it did not continue support for the prior PoW chain, but that chain still exists and can be used by anyone if they so choose https://www.circle.com/blog/usdc-and-ethereums-upcoming-merge. Given the heavy concentration of Ethereum development that will happen in NATO countries, what is stopping a forced fork from occurring if that can immediately separate any non-NATO country from the value of the chain? And if Ethereum itself is not forked, it is trivial for these western companies to launch a new chain and fully migrate there, or to any other chain that already exists, completely eliminating any value proposition of Ethereum overnight. How can an entity trust that any significant value is safe as a long-term non-sovereign store of value if the US or NATO can unilaterally force this to happen?

Bitcoin is exposed to a subset of the same risks though miner concentration in western countries, for example. But how it differs in one major way is likely all that matters: its entire value is derived from its role as a store of value. It is not at all reliant on applications or smart contracts built on top of it to create value and thus companies building on top of it do not control its fate. Any entity, anywhere on the planet can mine Bitcoin and as such the chain will exist in its simplicity, and thus its value, no matter what.

This naturally ignores governments outright ruling it as illegal, but that risk also holds true for gold. And much like gold, the US government cannot confiscate BTC held by entities outside of its jurisdiction. Similarly, the US government can not confiscate ETH held by entities outside of its jurisdiction, but it can mandate that no US companies can build on top of it, thus destroying its value proposition as ETH loses to BTC as an outright store-of-value option. In a world where both exist, Bitcoin’s singular simplicity wins every time.

ETH as an Internet-Native Commodity and Productive Onchain Asset

The final frame through which to view ETH is as an internet-native commodity, highly productive as an onchain asset and consumed in the process of providing a service. This is the view that we most closely ascribe to, and often arguments in favor of Ethereum as a cash flowing asset (consuming the asset in the course of using the chain via burn, provisioning block space as a ‘world computer’) point to this being the most accurate take on what ETH represents as a gas token, despite arguments to the contrary.

| Top Commodities by Estimated Market Value | |

| Oil | 100,000,000,000,000 |

| Gold | 17,000,000,000,000 |

| Bitcoin | 1,900,000,000,000 |

| Silver | 1,600,000,000,000 |

| Ethereum | 400,000,000,000 |

| Platinum | 240,000,000,000 |

| Palladium | 180,000,000,000 |

Outside of oil, gold, silver and Bitcoin, ETH is already the 5th most valuable commodity on the planet. Using ETH as an internet native commodity is highly valuable and as a productive asset is effective in enabling use of the Ethereum network to transact, either as a gas token or as an asset widely used as collateral in decentralized finance. There is no doubt about that.

However, it is hard to argue that ETH’s ultimate TAM is the $100T oil market cap. Gold, at $17T is a current bull-case target for Bitcoin, and it is increasingly likely that Bitcoin is the winner as a digital non-sovereign store of value, not Ethereum. Thus, is silver the strongest ETH comparison? A commodity with real use in industrial applications (i.e. over half the world’s annual demand is from industrial use) in addition to a small premium as a pseudo-store of value derived from speculation? That sounds feasible as a framework, but not necessarily as a value target. There is no sound argument that supports ETH’s market being related to, or even correlated to, that of silver.

But even so, once defined as a commodity to be used on the internet, the nature of the internet means it simply becomes working capital on the internet: a resource to be purchased and consumed in order to leverage the network. Why? The cost and time associated with acquiring and transacting ETH is increasingly approaching 0 (a tremendous feat of engineering by all involved). Across any industry, the level of resources required to produce an output are held to the minimum level possible by companies to reduce carrying and other costs from e.g. expiration or price fluctuations and to minimize tying up capital. Airlines, for example, do not stock years’ worth of fuel in advance. Instead, given the carrying costs and associated risks of storage, they hold a few weeks’ worth of fuel stock, at most, and heavily hedge price exposure through derivatives (which itself is even too capital intensive for many to do).

As a more apt comparison, given gas costs are likely to be such a trivial portion of operating costs for most, there is little reason to expect they will be treated much differently than how companies today utilize cloud computing credits or even electricity costs. Blockchain spend will be a fraction of a company’s compute demand and because of the permissionless nature and low cost to access, gas spend will be far lower than cloud spend and definitionally done so on a pay-per-use basis. This assumes that transaction costs are eventually internalized by the company and not passed on directly to the user as they are today. But if the standard model continues to put that burden on users, demand for latent gas resources will be even lower.

Through predictive analytics and supply chain optimization, commercial production is trending towards just-in-time delivery of all inputs to better enable on-demand production and to improve capital efficiency (i.e., perform the same activity with less capital tied up on the balance sheet). Less and less are companies keeping excess inventory of consumables on hand. Why would using a highly volatile internet commodity, with instantaneous acquisition and storage, be any different?

The strongest argument for maintaining excess stock of ETH on hand is that the carrying cost of it is essentially 0. After all, once a $100 cold wallet is purchased, there is zero direct marginal cost to store an additional unit of ETH for an additional unit of time (though there is a real opportunity cost of not being able to invest that $100 elsewhere). This may be true for retail consumers, but commercial entities require far higher degrees of security to custody assets (e.g. through Fireblocks, Coinbase, Anchorage, Copper, etc.), and these costs are far from zero for commercial-scale custody. There is also major risk in having to hold funds in a hot wallet to enable transactions; any large holders would likely have to store any substantial amount of ETH in cold storage, which runs counter to its use as a gas mechanism and introduces substantial inefficiencies to transacting.

Further, all development points towards the industry getting to instant, free swaps. On Base, one can swap $10 of USDC for ETH for a few cents in just 2 seconds. That $10 of ETH enables 5,000 onchain transfers, a count that is expected to quickly climb as Base further improves its throughput and optimizes batching spend. Why would a business hold any more ETH than necessary on their balance sheet with the cost to acquire so low and amount needed so minimal? Given ETH’s volatility, holding any greater amount of ETH would be more costly due to the price swings than having to incur any additional 1 cent transaction fees in the future. There is also a real opportunity cost of the capital held in ETH that could otherwise be reinvested in the business, other productive assets, or returned to shareholders. Continued development of other L2s and L3s with free, sub-second transaction speeds and alt-L1s with competitive performance only strengthens this trend.

This raises another important issue often overlooked by those espousing ETH as an internet commodity. Companies around the world, with costs and offchain revenues all denominated in USD or other local currencies, will not want to hold a volatile asset on their balance sheet at size that is simply short-term inventory required to use a piece of their backend tech stack.

USD-denominated stablecoins (over $100B in circulating stock on Ethereum) and tokenized treasuries provide any offshore business access to a stable store of value if their intent is to protect against in-country devaluation https://defillama.com/stablecoins/Ethereum. A subset may elect that they would rather match inventory denomination to use, e.g. ETH to pay gas costs, but for reasons outlined above, this will not be the norm, nor will it amount to a sizable amount given the strong trend down in transaction costs and risk of holding a truly permissionless asset. This is only further solidified by the fact that it appears most execution will likely happen on L2s, not on mainnet.

This means - with the industry trending towards 0 fees, instant swaps, full abstraction and gasless sends (i.e. gas can be effectively paid in a non-gas token such as USDC) - companies will more likely hold stables, denominated 1:1 with their own operating currencies, and simply consume ETH resources only if and when necessary. Demand is thus likely to be largely instantaneous. There is no long-term dormant demand from businesses holding ETH for gas in this future.

ETH is widely used as collateral in lending protocols such as Aave and as a deposit asset in staking and restaking protocols, such as Lido and Eigenlayer. To date, these have been incredibly successful use cases and have generated those protocols and their users hundreds of millions of dollars in revenue. However, the long-term competitive equilibrium of the current status quo is highly fragile.

Why? Again, due to ETH’s volatility. On Aave, the largest lending protocol in DeFi by far, users can borrow stablecoins against ETH at a 0.75 LTV. That is, for every $1000 of ETH deposited, users can borrow $750 USDC. This is highly, highly capital inefficient, and only gained prominence due to a) the lack of fractionalized and unsecured onchain lending available in the market, b) the lack of alternative quality capital, and c) the speculative nature of ETH and the associated market’s demand for high amounts of leverage. The opportunity cost of capital here is only further exacerbated by the time costs – and risks – associated from the liquidation mechanisms in place on many of these protocols. Severe short term price dislocations are common in digital assets and have often led to positions being liquidated for only this reason, and none to do with the borrower’s actual ability or willingness to repay the debt.

This too will change. Fractionalized and unsecured lending is the lifeblood of financial markets. Unsecured debt is roughly 80-90% of total outstanding debt in traditional markets. As better technologies and protocols are built, including increased adoption of RWA, the need for onchain collateral will decrease, as will the volatile ETH asset being used relative to far more stable tokenized treasuries and commercial paper, as is done in traditional markets https://www.newyorkfed.org/medialibrary/media/outreach-and-education/household-financial-well-being/the-role-of-fintech-in-unsecured-consumer-lending-to-low-and-moderate-income-individuals. As a thought experiment:

I have the option to collateralize $100 of tokenized US treasuries at an LTV of 90% vs. $100 of ETH at an LTV of 75%. From a capital efficiency standpoint and liquidation risk (and thus overhead cost) why would I use ETH? Even if tokenized treasuries are collateralized at a similar LTV of 75%, outside of taking a speculative position, why would I as a borrower incur additional costs solely in order to use ETH?

Yes, ETH may still be used as collateral to a certain extent, much like how inventory financing or other forms of asset-based lending are still common in traditional finance. But the size and commonality of that is far lower than using treasury/paper as collateral or simply accessing credit-based unsecured loans.

ETH is also frequently positioned as an “internet bond”. That is, through staking ETH, a holder can earn a share of new issuance. At long term equilibrium, this is designed to be roughly 3% on Ethereum. However, that native yield does not represent entirely net ‘new’ yield for stakers. Rather, that yield serves to allow stakers to maintain their share of the ever-diluting network caused by validator rewards, plus a de minimis ‘real’ yield above that. The volatility in ETH is far too high to be used by rational actors as an “internet bond”. The associated yield of 3% does not nearly overcome the 25%+ annualized volatility and inherent risk and costs associated with staking ETH if execution economics are taken out of the picture.

Restaking protocols allow stakers to opt in to securing additional chains or applications for a share of rewards to earn additional yield beyond the native issuance, but this comes through exposing those stakers to additional (and often unclear) risk. Further, the long-term demand and actual viability of sustained valuable yield through these channels remains speculative.

Staking naturally is a strong use case for ETH, and given this is the permanent structure for Ethereum security, is unlikely to change going forward. However, the network has already nearly reached its algorithmically designed long-term equilibrium of roughly 1/3 of ETH staked earning 3%. This monetary policy is likely to change, as it has in the past. While this could increase the attractiveness of staking or holding the asset, it likely only improves the opportunity at the margins while also necessarily introducing another future unknown, which only increases the associated risks of the investment today. Without any change, more staked ETH programmatically results in reduced network yield, decreasing the attractiveness to the next marginal investor evaluating whether to stake or not.

Ethereum’s Roadmap Reinforces this Path Dependency

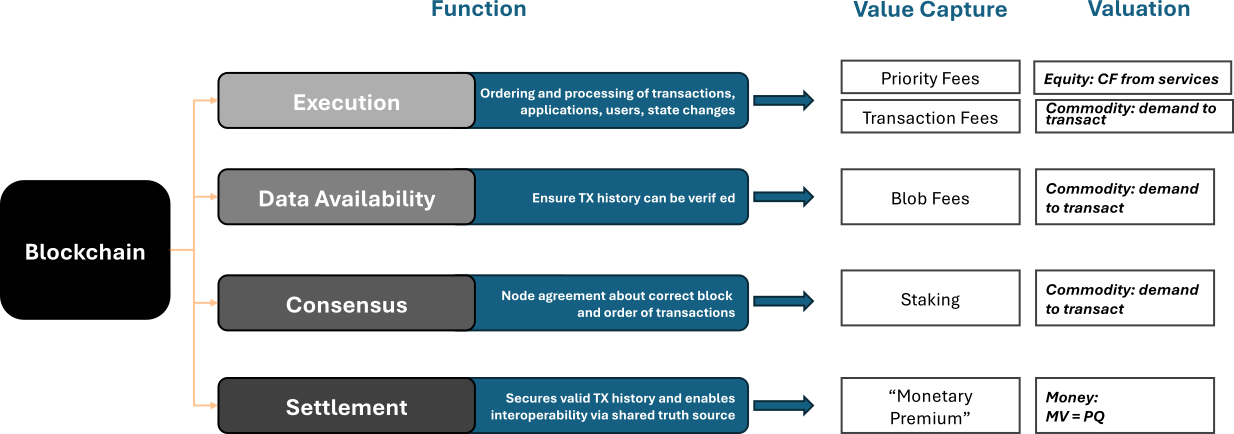

At their core, blockchains perform four primary functions that together enable permissionless value transfer on the internet. Execution is the ordering and processing of transactions, where state changes occur and the actions of applications happen. Data Availability ensures that the required transaction history can be verified by participants in the ecosystem. Consensus is the agreement between nodes about the correct order of transactions and block propagation. Finally, settlement secures the valid transaction history and enables interoperability across all actors in the ecosystem.

Each of these are vastly different functions and as such, there is no one-size-fits all approach to valuing these. As we presented earlier, viewing an asset like ETH as an equity or simply as money is highly problematic. Viewing it as a compute resource, an internet-native commodity, is the most appropriate stance for the reasons we detailed above. Each step along Ethereum’s technology roadmap brings it asymptotically closer to this truth.

Execution

Execution is simply the service provided by the network to its users by facilitating transactions directly or through applications. In exchange, these users pay transaction fees - a portion of which flows to validators and stakers in the form of priority fees, and a portion of which is burned as the base transaction fee. This is the core functionality that is explicitly being pushed to L2s as part of Ethereum’s scaling roadmap. Any remaining execution will be far more efficient (and thus cheaper) due to upgrades such as full danksharding, larger blocks, faster block times, pre-confirmations or single slot finality. Ethereum still facilitated 84% of execution in January 2022. That share has dropped to just 6% today and is likely to continue falling https://www.growthepie.xyz/fundamentals/transaction-count.

The base transaction fee accounts for 70-90% of total fee generation on Ethereum mainnet recently, but this is likely to continue to grow in share as throughput on mainnet is expanded and competition for blockspace (and thus priority fees) is reduced with execution shifting to L2s. As we explored earlier, the most likely future is one where any business/application of sufficient size will deploy its own network rather than remain on a single shared ledger, much like how companies have broadly moved away from shared hosting. This has the direct impact of putting downward pressure on mainnet demand for ETH over the long run. Unfortunately, winning on execution is also the clearest path to retaining value capture for ETH as stakers directly benefit from execution economics (see ETH economic flow chart above).

Data Availability

Data Availability is the function of ensuring that any transaction history is adequately available to nodes on the network should it be needed for e.g. verification. This is fundamental to a network’s security and decentralization but has the potential to be a significant demand on resources. Ethereum’s focus on moving execution to L2s has necessitated the need for efficient verification of transactions processed offchain. Historically, rollups have posted these batches of transactions as CALLDATA on Ethereum, a relatively expensive way to ensure availability, primarily due to its permanency. Roadmap scaling improvements, and specifically EIP-4844, created an alternative mechanism through which rollups can post this data (“blobs”) with their own fee market separate from the general transaction fee market.

This upgrade was incredibly successful, cutting rollup costs by nearly 99%. However, its impact on the demand for ETH the asset is two-fold. First, that 99% reduction definitionally represents a 99% reduction from L2s requiring ETH for payment, a substantial hit to demand. Secondly, by moving execution offchain to L2s and then shifting gas demand to a separate market, the remaining competition for ‘general’ blockspace is substantially lessened, thus depressing the aggregate level of demand for ETH for all remaining mainnet activity broadly.

There is some expectation that the proliferation of L2s and L3s in the future will lead to enough demand for Ethereum blobspace to offset this. The cost of posting these blobs is free floating and can thus adjust based on demand but Ethereum’s roadmap includes multiple upgrades that target expanding blob capacity substantially, which definitionally serves to keep fees low. Technologies such as ZK aggregation will allow much of these costs to be amortized across rollups, thus reducing posting costs even further.

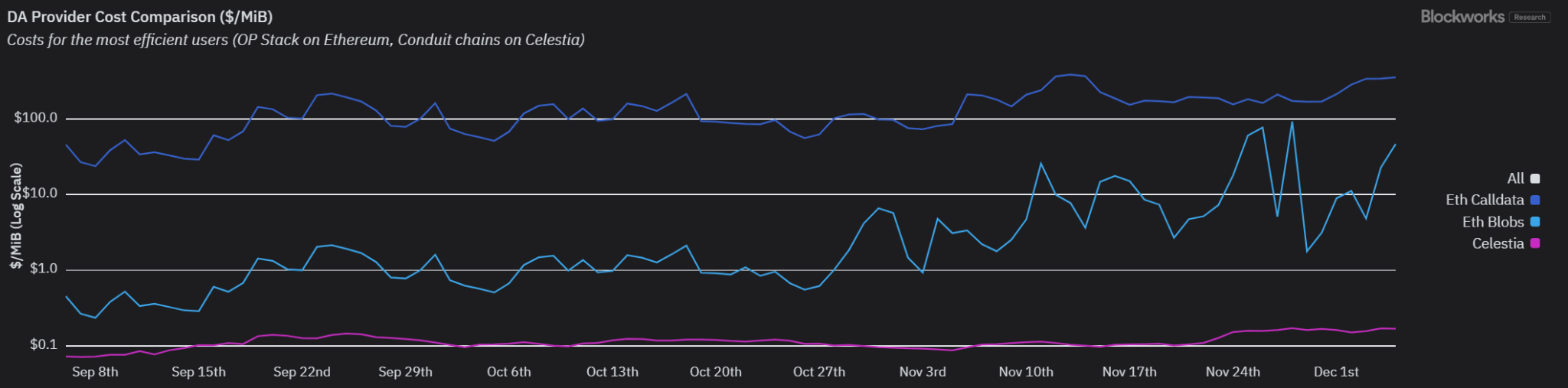

New networks entirely dedicated to providing rollups with Data Availability are rapidly coming to market, such as Celestia, EigenDA and Avail. Many have the potential of offering far higher capacity for far lower cost than Ethereum’s DA and early adoption has proven that L2s are willing to trade the security and network effects of Ethereum for a lower-cost solution https://app.blockworksresearch.com/analytics/tia. At the end of the day, rollups are businesses and aside from L2s that require the strictest alignment with Ethereum as the ‘premium’ option (e.g. Optimism, Arbitrum, based Rollups), it is difficult to posit a future where Ethereum’s DA will be the default choice for the next marginal rollup to deploy given the competitive alternatives that exist. One caveat to this is that the long-term sustainability of a network solely providing DA is likely untenable. Other economic drivers must be in place to support the increasingly commoditized DA provision.

Consensus

Consensus covers the mechanism through which nodes agree on the next valid block of state updates amended to the chain. Ethereum’s design and the rise of liquid staking derivatives have led to the network reaching its target stake level in short order: roughly ⅓ ETH staked earning 3%. Though changes to this are currently being debated, this represents the single largest demand vector for ETH as a productive asset. Validators are required to stake 32 ETH as a security feature, though this is soon likely to represent a lower limit, with an increased upper limit of 2048. There are other upgrades targeted at increasing vote efficiency, but aside from allowing node operators to aggregate stake to lesser validators and improve efficiency of both their operations and of consensus, this likely has limited impact on changing the aggregate demand for staking, all else equal. Rather, it largely represents how that stake is subdivided among validators and to a lesser extent node operators themselves.

With that said, a primary roadmap consideration is to increase the ability of solo stakers to participate, effectively enabling a validator with just 1 ETH. Naturally, this is in direct opposition to many of the proposed efficiency upgrades as the votes required for consensus increase as the number of validators increase. There is substantial research ongoing around how to balance these competing objectives and it is likely that the developers will succeed (MPC? slower block times?). However, as a rational investor, this introduces substantial risk into the asset given there is a considerable lack of clarity around the ultimate market structure for ETH. As we illustrated earlier, the economic flows within Ethereum are highly sensitive to the share of ETH staked.

Settlement

The final function, settlement, refers to securing a valid transaction history while providing a shared source of truth across which actors are able to interoperate. In essence, transacting in a shared unit of account, otherwise known as money. At mature equilibrium, settlement on Ethereum increasingly appears to be the validation of L2 batches and the small subset of activity that remains on mainnet. This is an undeniably valuable function, but is determined by the size of the economy that it supports - the direct need for the L1 asset to support the activity. If (when) AI and bots play a larger role in transacting, definitionally velocity is set to increase and thus reduce the required stock of ETH required all else equal. Roadmap items all serve the purpose of expanding how large this economy can grow over time, but as we outlined above, the monetary stock of Ethereum is already ~1000x larger than is required by its current economy. That is a high bar to grow into and an already massive ‘monetary premium’ in place.Where Does That Leave Us?

At $400B today and given its current trajectory, it is difficult to justify ETH as a rational investment on a risk-adjusted long-term horizon, no matter which lens you use to value it. While the technology itself and the spread of the EVM has the potential to be wildly successful, as we believe it will be, the industry far too often ignores that the real world still exists and that this technology does not live in a separate bubble, wholly detached from reality with unlimited uncapped upside and 100% market share. The internet broadly, and blockchain technology specifically, is a subset of global commerce, not the other way around.

Making execution a first-class citizen again, where applications and rational actors will prefer to transact, is likely the best path forward. Increasing gas limits, suppressing base fees (but leaving the door open for strong growth in priority fees), can help bring back high-value execution and a semblance of value accrual back to ETH. As a ‘money’ that has only instantaneous demand and frictionless swaps, asset value collapses to working capital. Given the reliance on real world adoption to drive store-of-value premium, ETH likely cannot steal that mantle from Bitcoin.

There will undoubtedly be significant price swings in the interim, and the market cap of ETH may very well begin a march towards $1T or more, but any position here should likely be viewed as a time-boxed trade against speculation and near-term infrastructural inefficiencies rather than as fundamentally driven long-term investment based on ETH’s roadmap and what that means for it as an internet commodity, as a cash flowing asset, or as ‘money’.

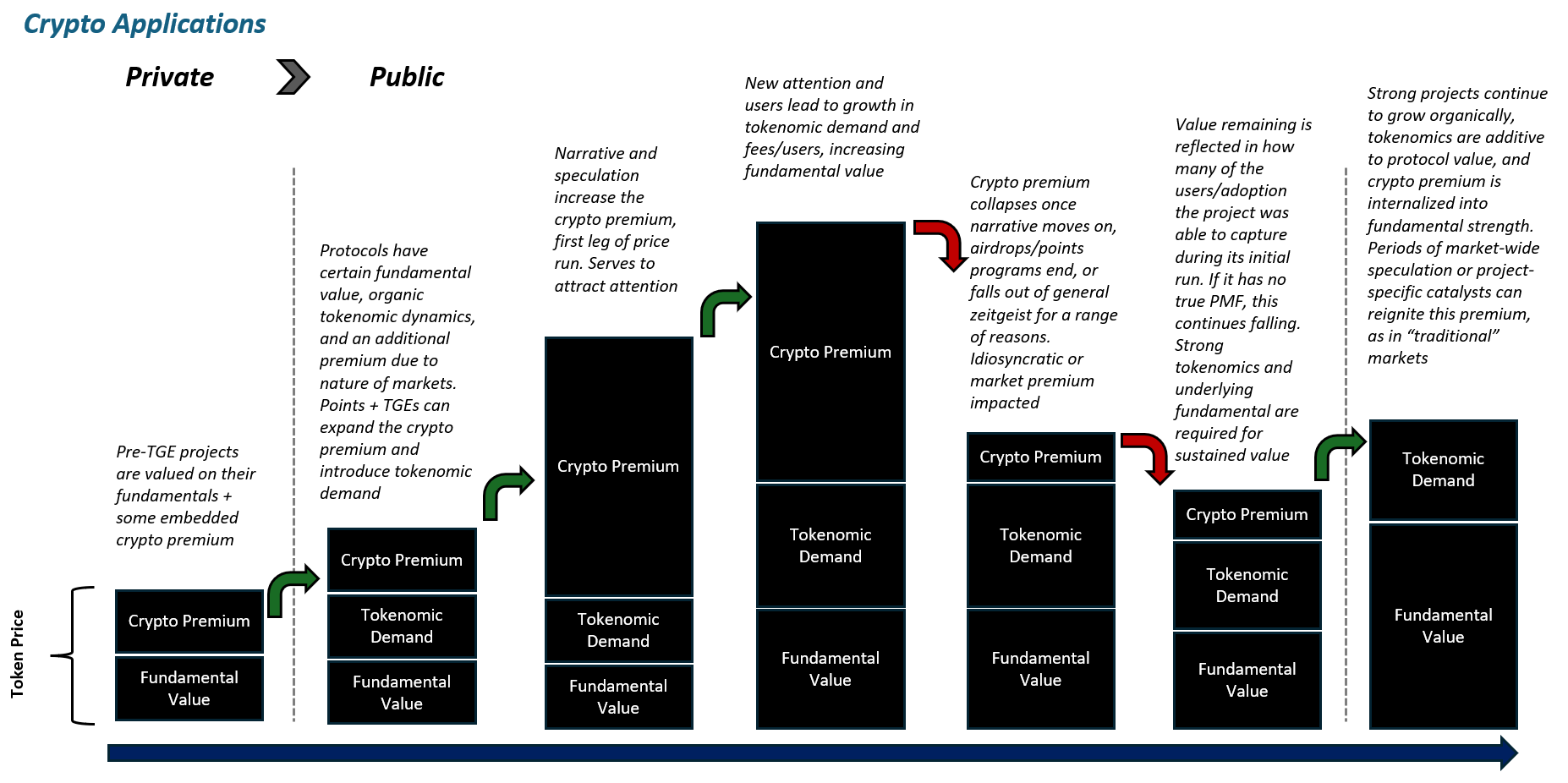

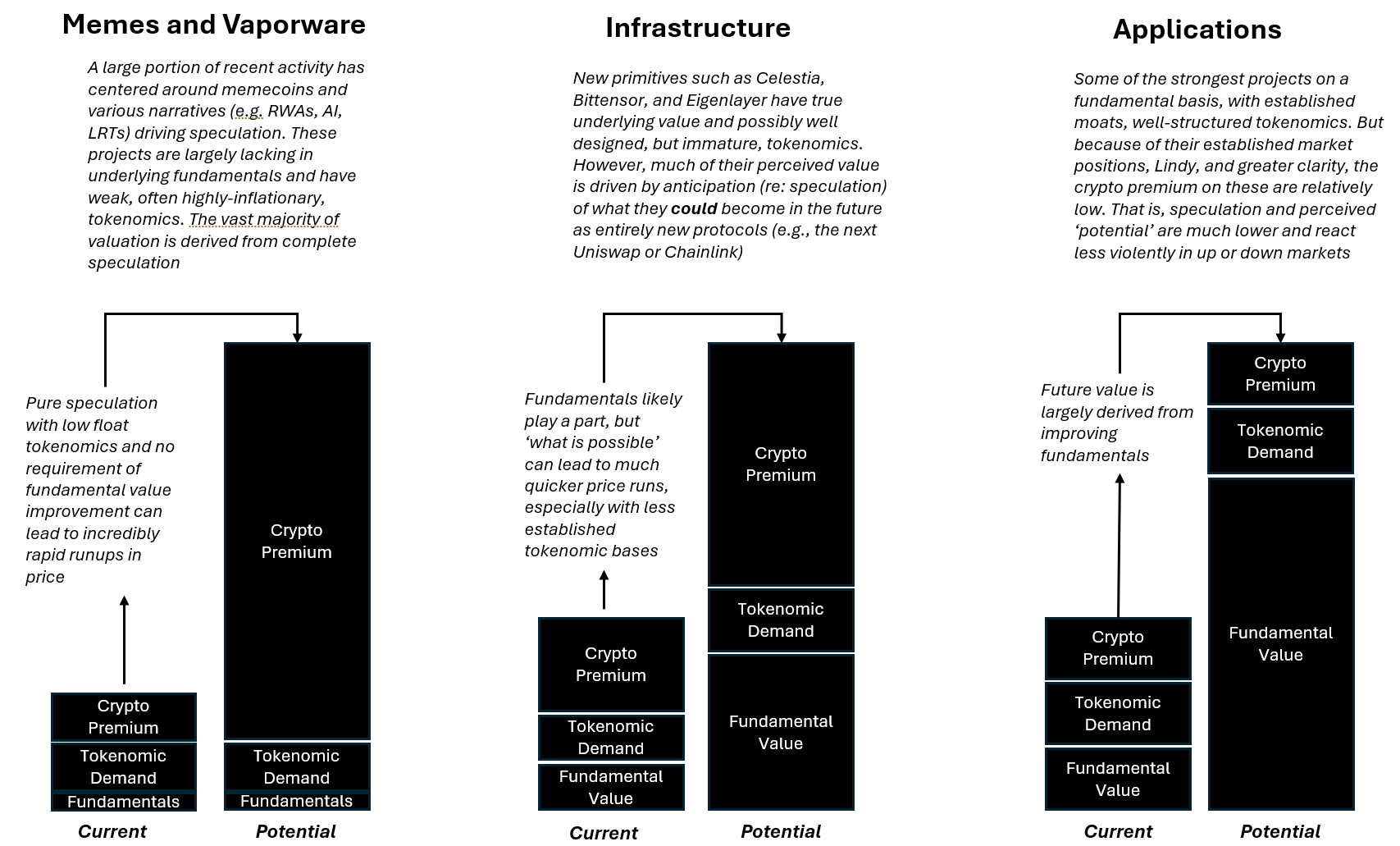

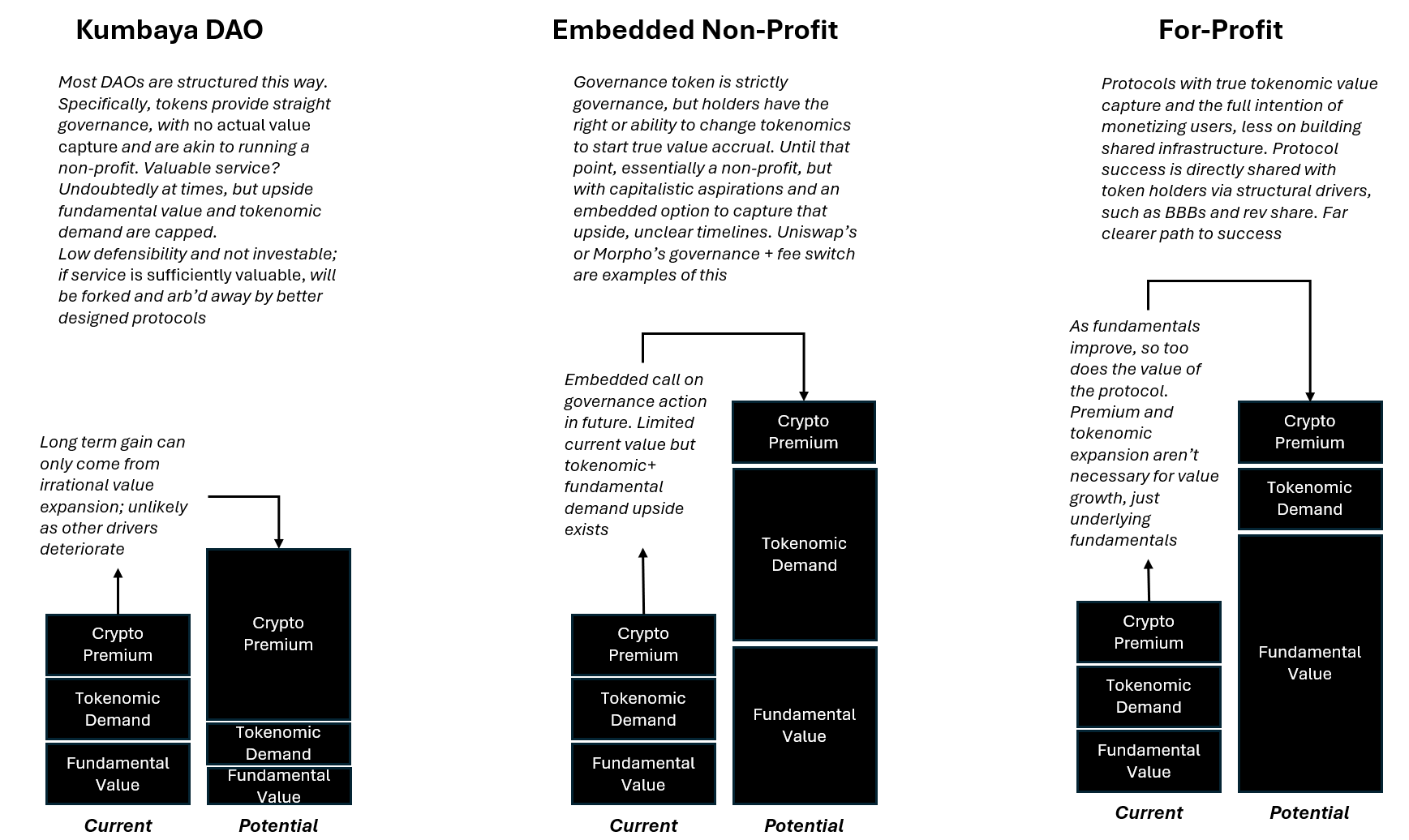

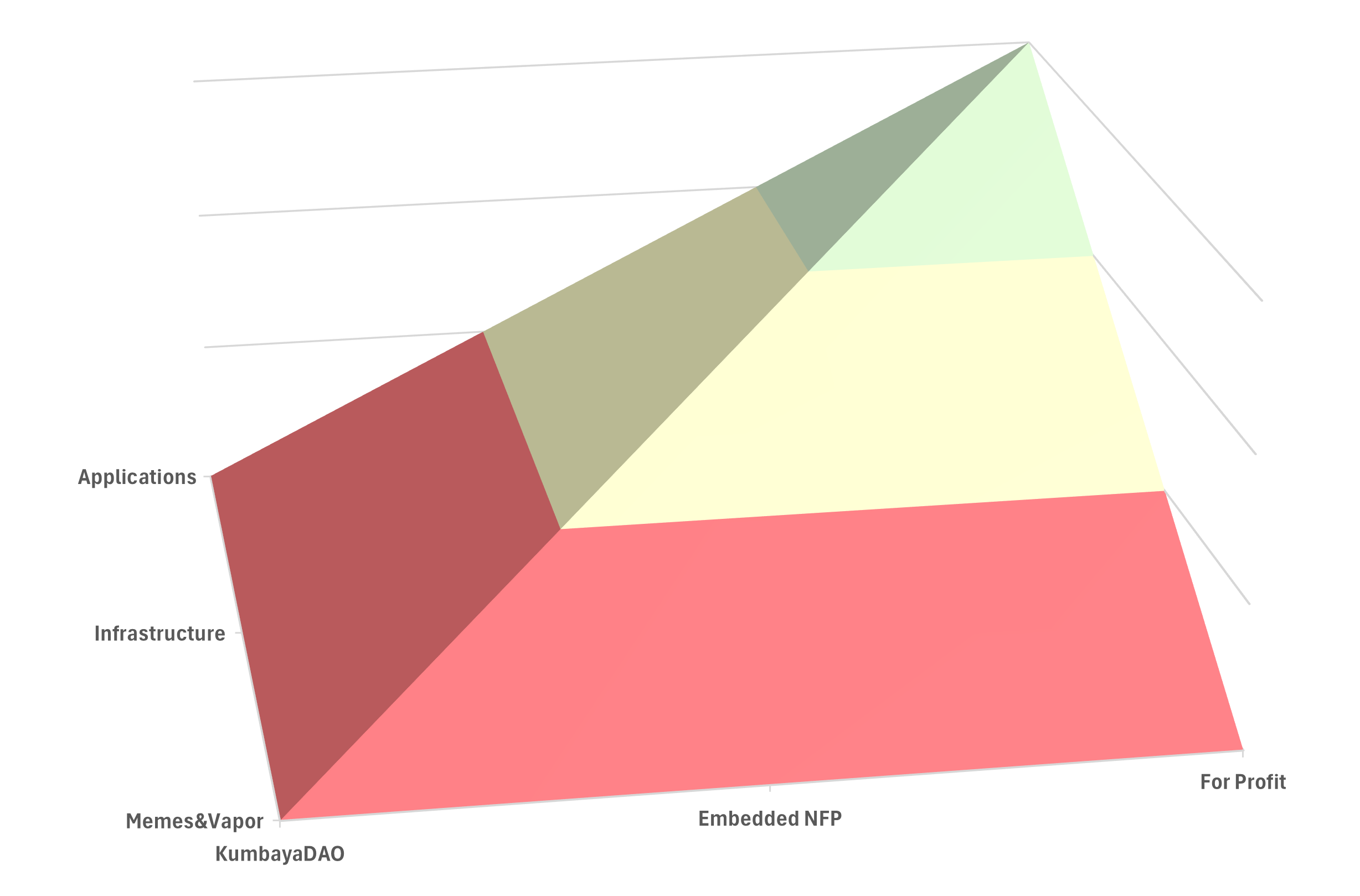

If Not ETH, Where is the Value?

BTC still holds its position as a sound risk-adjusted bet that it can grow into its role as a non-sovereign store of value. Beyond that, excluding short-term trades, it is increasingly difficult to justify many L1 and L2 investments based on fundamentals. There is potential for many to reach valuations in the hundreds of millions or billions of dollars, but only those with the underlying mechanisms in place to sustainably capture rent from their users at maturity. The vast majority will fail to meet this single criteria, and many that are currently valued this high fail to do so in any meaningful way.